unrealized capital gains tax yellen

A 2 drawdawn on your unrealized capital gains requires people to have set aside cash for that very tax purpose. President Biden Unveils Unrealized Capital Gains Tax for Billionaires.

Opposed To The Unrealized Capital Gains Tax R Elonmusk

Yellen said Biden has not proposed a specific wealth tax but would tax the investment income of families making more than 1 million at the same rate they pay on.

. Ron Wyden D-Oregon would impose an annual. Of course like the controversial 600 IRS monitoring proposal Yellen stressed. Instead of paying taxes when you finally sell your home or cash out your 401k or trade stock you would be taxed on the subjective made-up unrealized value gain right now.

The plan will be included in the Democrats US 2 trillion reconciliation bill. Yellen had first proposed the tax on unrealised capital gains in February 2021. A 2 drawdawn on your unrealized capital gains requires people to have set aside cash for that very tax purpose.

Treasury Secretary Janet Yellen explained on CNN Sunday that the proposal raised by Sen. Since then many wealth managers from Howard Marks to Peter Mallouk as well as many others have argued that this. Yellen said lawmakers are considering a billionaires tax to help pay for Bidens social safety net and climate change bill.

Treasury Secretary Janet Yellen is currently considering some shocking policies. Wealth managers believe this could spook investors in the US and that could move money towards emerging economies which includes markets like India. It means that on average you can defer cap gains 10 years 1 10.

Unrealized capital gains put simply is the increase in the value of an asset that has yet to be sold. Yellen made the remarks in response to a question from Tapper about whether a wealth tax should be part of how Democrats look to pay for Bidens 35 trillion. US Treasury Secretary Janet Yellen has proposed a hike in capital gains tax as well as taxing unrealised capital gains.

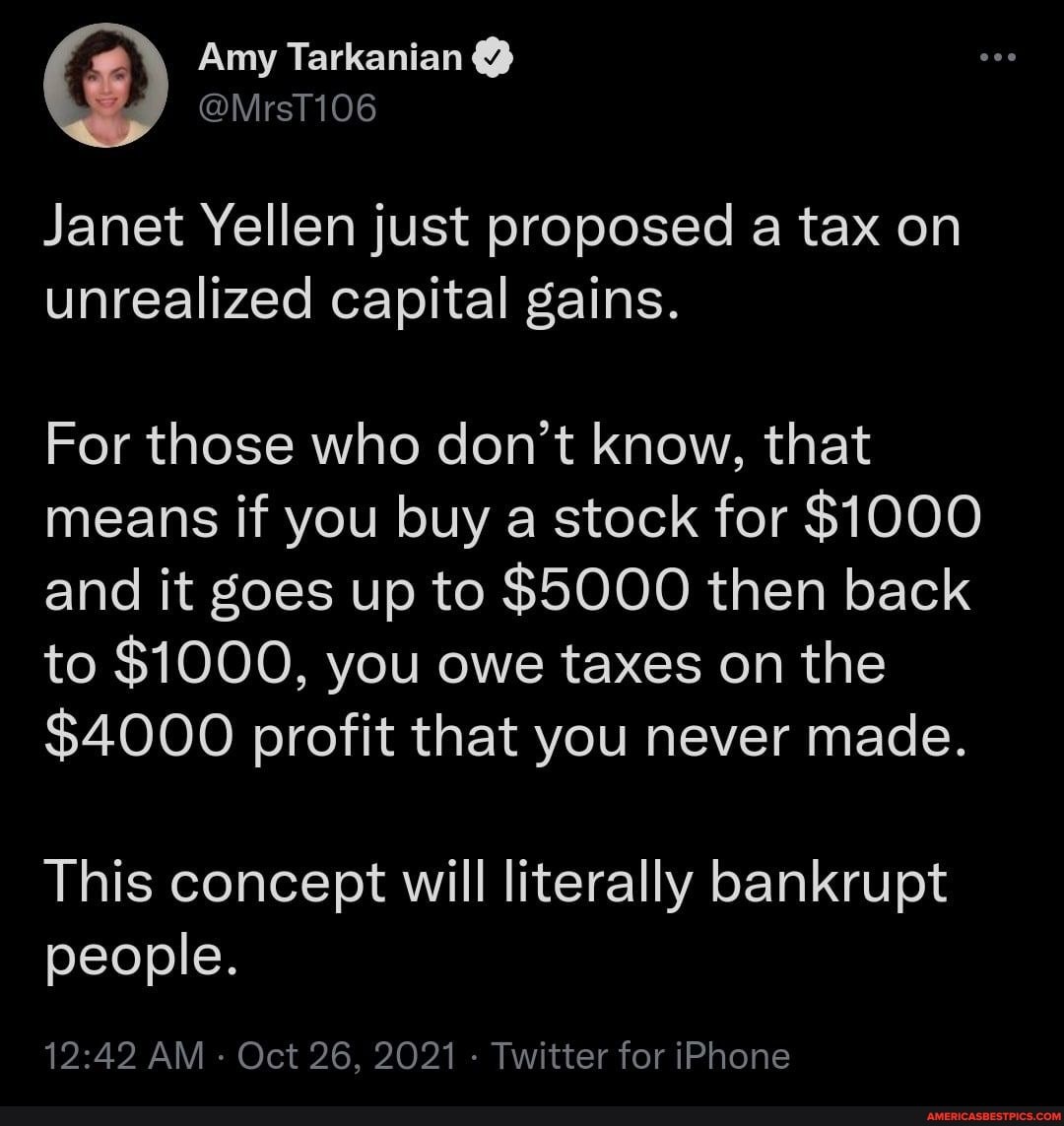

The United States Treasury Secretary Janet Yellen has announced the proposal of a new tax that could hit unrealized capital gains. An unrealized gain is when something you own gains value but you dont sell it like your house or your retirement fund. Treasury Secretary nominee Janet Yellen reportedly said she would consider taxing unrealized capital gains but billionaire investor Howard Marks said its not a practical plan and could.

Earlier in 2021 Yellen proposed taxing unrealized capital gains to boost US. Yellen explained the concept which aims to tax Americans on unrealized capital gains stemming from liquid assets. Government coffers during a virtual conference hosted by The New York Times.

Treasury Secretary Janet Yellen announced on Sunday that a proposed tax on unrealized capital gains yes gains from investments that havent even been sold yet could help finance President Bidens new 2 trillion social spending bill. A Texas resident would see the following taxes. Capital gains tax is a tax on the profit that investors realize on the sale.

Secretary Janet Yellen has been discussing in various media the Biden administration is now revealing an unrealized capital gains tax from stocks and bonds. In terms of long-held estates the unrealized gains will mostly be gains over just the last ten years not multi-decade gains. Total long term capital gain rate 434 Now the Biden admin wants to tax you every year on how much your asset has increased in value even if you.

We also see that forcing 10 of unrealized gains to be realized and taxed simply puts a limit on how long you can keep deferring your taxes. It goes against the concept of taxing income because thats a tax on generated cash flow whereas there is no generated cashflow in. Would you then get.

That sounds good until you realize that 100000 increase was an unrealized gain. Yellen is a communist plane and simple. Eagle-Keeper January 21 2021 951pm 1.

It looks like Janet Yellen would like to tax unrealized capital gains. Taxing unrealized capital gains also known as mark-to-market taxation What is an unrealized capital gain. NEW US.

Ron Wydens plan to tax unrealized capital gains of billionaires is something else. Tax pyramiding obscures the impact of taxes on taxpayers while creating situations. WEALTH CAPITAL GAINS TAXES.

Bidens newly appointed US. It goes against the concept of taxing income because thats a tax on generated cash flow whereas there is no generated cashflow in. The Biden Administration is pretending that Oregon Sen.

Federal long term capital gain rate 396 BidenYellen proposal v 20 today. National Investment Income Tax 38. And if you dont pony up for Janet Yellens salary the government is coming for you.

FTTs tax financial trades placing another tax on top of existing taxes on capital gains and corporate income. Treasury Secretary Janet Yellen told CNNs Jake Tapper on Sunday that Senate Democrats are considering a proposal to impose a tax on unrealized capital gains of the wealthiest Americans. Texas long term capital gain rate 0.

Not exactly sure how that would work especially if the next year the stock price drops below what you paid for it. That sounds good until you realize that 100000 increase was an unrealized gain.

Cryptowhale On Twitter Us Treasury Secretary Janet Yellen Suggests Imposing A Tax On Unrealized Capital Gains This Means Stock Gains Will Be Taxed Even When They Have Not Been Sold It Also

Unrealized Gains Tax Is Targeted To Billionaires Not Apes Don T Let Fud Make You Kenny S Bootlicker R Superstonk

Here It Is Wyden S Unrealized Capital Gains Tax On Wealthy Americans Swfi

Janet Yellen S Idea To Tax Unrealized Capital Gains R Wallstreetbets

Us Government Unrealized Gains Tax Plans Might Hit Crypto 039 Billionaires 039 Too In 2021 Bitcoin Currency Wealth Tax Capital Gains Tax

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Busines Capital Gains Tax Capital Gain What Is Capital

Best Argument Against Unrealized Capital Gains Tax Janet Yellen Capital Gains Tax Youtube

Bloombergquint On Twitter Yes Taxation Of Unrealised Stock Market Gains Seems Unusual But It Is Already Embedded In The System Argues Shankkaraiyar Calling For A One Time Tax On Billionaires He Points To

No U S Won T Tax Your Unrealized Capital Gains Alexandria

Janet Yellen Favors Higher Company Tax Signals Capital Gains Worth A Look Business Standard News

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

Nancy Pelosi Says A Wealth Tax On Billionaires Unrealized Gains Is On The Way Mish Talk Global Economic Trend Analysis

Janet Yellen Proposes Insane Capital Gains Tax On Bitcoin Youtube

Janet Yellen Just Proposed A Tax On Unrealized Capital Gains For Those Who Don T Know

Yellen Argues Capital Gains Increase From April 2021 Not Retroactive Bloomberg

Opposed To The Unrealized Capital Gains Tax R Elonmusk

Elon Musk Weighs In On Unrealized Capital Gains Tax Idea Channelchek

Does Treasury Secretary Yellen Really Want Unrealized Capital Gains To Be Treated As Income Swfi